Tactical insights for first-time founders to outsmart the burn, the churn & the breakdown.

Hey Founder,

A lot of first-time founders carry a quiet safety net: “If this fails, I’ll learn and do it better next time.”

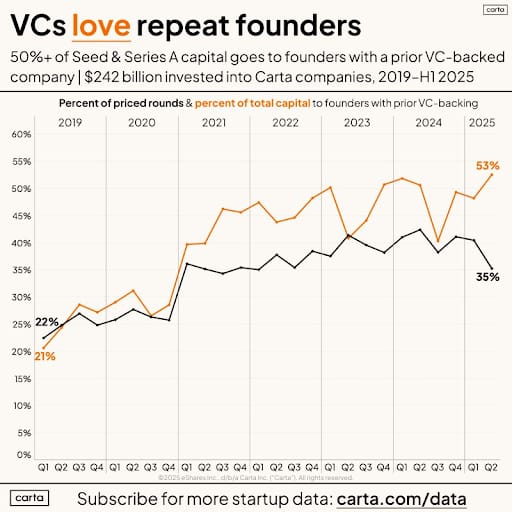

And sure, the data seems to back that up. Repeat founders succeed more often and tend to raise on better terms than first‑timers.

But here’s what that stat hides.

Most of that “upgrade” is bought with a messy cap table, painful terms, broken unit economics, years stuck in a company that can’t be fixed, or exited cleanly.

Company #2 isn’t magic.

It’s the same founder, just carrying a list of expensive mistakes they won’t repeat.

So the real question isn’t whether repeat founders do better. It’s this: Do you actually need to burn a company to earn that judgment?

What if your first company didn’t have to be the practice run?

What if you could build with repeat-founder clarity from day one?

Let’s talk about how.

The Margin

What second‑time founders actually change

You may have seen a post by Nikunj K (FPV Ventures) comparing first-time and second-time founders. The difference isn’t talent, it’s where effort goes. 🫳🎤

First-time founders push: forcing sales, overbuilding features, fixating on launches and valuation.

Second-time founders pull: investing earlier in distribution, systems, positioning, and networks that create momentum with less friction.

You see this shift between companies.

Reed Hastings took scars from “Pure Software” and turned them into hard rules at Netflix around culture, talent density, and focus - "we're a team, not a family," and context over process.

Evan Williams went from Blogger to Twitter to Medium with a clearer sense of what actually drives adoption, and why being the single point of failure is so expensive.

Travis Kalanick entered Uber with far less tolerance for bad economics and weak terms after Red Swoosh almost killed him before a modest exit.

Same founders. Better judgment.

And you don’t have to burn Company #1 to get there. Some founders make this shift inside their first breakout business by asking naïve questions early, bringing in people who’ve done it before, and changing how they decide and delegate as they grow.

From the outside, that looks like experience. From the inside, it’s simply knowing which lines you won’t cross.

Tiny Reframe

Second‑time founder is a mindset, not a résumé

Investors don’t just like repeat founders; they price them differently. Second-timers tend to raise faster, on better terms, with more trust and room for error.

But “second-time founder” isn’t a badge. It’s a way of showing up. This is what that way looks like:

Knowing why you're building this company and what you want from it.

Having clear lines on teams, terms, margins, and priorities you won't tolerate.

Showing you learn fast without having to blow things up to prove it.

It’s less about how many logos are behind you and more about how reliably you avoid making the same mistake twice.

You don’t need a second company to get there.

You can be that founder in your first.

5 Margin Moves to Build like a Serial Founder

1. Get ruthless about what you’re not building

Second-time founders have lived the cost of trying to serve everyone. They draw boundaries early.

Be explicit about:

who you’re not building for,

which use cases you’ll ignore,

which deal sizes and custom requests you’ll say no to.

If most of what you’re doing doesn’t clearly point to one customer, one problem, and one outcome, you’re still treating this like a practice company.

2. Keep shipping until your ICP and message lock in

Repeat founders don’t fall in love with the first launch that “kind of works.”

They run small, frequent launches and only trust paid signals:

Who actually pays?

Which message gets them to pay?

Which segment keeps buying?

Which motion consistently drives revenue?

When your last 10–20 customers look similar and buy for the same reason, you’re getting close. If they don’t rhyme yet, you’re still guessing.

3. Design distribution as a system, not a hope

“We’ll figure growth out later” is how weak engines get patched with bad capital.

Look back at the last 30–90 days and identify the one motion that actually brought in paying customers. Then:

Commit to building that motion into a repeatable system over the next quarter.

Everything else is maintenance until one engine works without you.

Second‑time founders treat distribution like product: designed, tested, owned - not wished for.

4. Fix the margin before you fix the volume

Second-time founders have already learned that scaling bad economics just accelerates the damage.

If your margins are meaningfully below what’s normal for your business model, pause the growth heroics. Fix pricing, scope, and delivery costs first. Volume won’t save a broken margin.

Rough sanity bars:

SaaS: ~70–85% gross margin.

Services/agency: ~40–60%.

E‑com/physical: ~30–50%.

Get the economics to “this would be worth it at 5–10× the size” before you try to go 5–10×.

5. Kill quiet equity mistakes early

Serial founders are allergic to casual dilution. They’ve seen how “a few percent here and there” adds up.

Do this thought experiment now:

Sketch your success cap table, after the likely next 1–2 rounds.

Run the exit in your head: if this works, is what you own worth the years you’ll put in?

If the answer isn’t a clear yes, fix it early, not after the next round.

(There’s a reason why repeat founders own more of what they sell)

Tough Love Corner

A founder asked me last week:

“If we’re bootstrapped, profitable, and sitting on cash with no debt, when does a business credit card actually make sense?”

Use a card when you have a predictable cash-timing gap, not when you’re short on money.

That usually means recurring monthly spend in the $15k–$30k+ range, a consistent delay between paying expenses and receiving customer cash, and the ability to pay the balance in full every month from operating cash.

At that point, a card isn’t emergency debt. It’s working-capital float.

It keeps more cash in your account for longer, smooths timing, and improves visibility into spend. Rewards are secondary; the timing is the real benefit.

If you need a card to survive, don’t get one.

If you’re using it to optimize a business that already works, it’s a tool, not a crutch.

Got a burning founder question?

Send it my way, just hit reply.

Founder’s Toolbox

Must-reads for founders:

Before you go…

First-time founders have a few underrated advantages. You’re not carrying old scars that make you hesitate, past wins that narrow your judgment, or habits you need to unlearn. You’re building with fresh eyes, real hunger, and belief that hasn’t been worn down yet.

Pair that with the “build like a repeat founder” moves we just covered, and the odds start to flip. Deliberate execution beats experience every time.

That’s the real moat.

See you next Thursday,

— Mariya

What did you think of today’s issue?

Hit reply and let me know. I read every single one (for real).

About me

Hey, I’m Mariya, a startup CFO and founder of FounderFirst. After 10 years working alongside founders at early and growth-stage startups, I know how tough it is to make the right calls when resources are tight and the stakes are high. I started this newsletter to share the practical playbook I wish every founder had from day one, packed with lessons I’ve learned (and mistakes I’ve made) helping teams scale.