Tactical insights for first-time founders to outsmart the burn, the churn & the breakdown.

Hey Founder,

Profitability isn’t the goal; it’s the threshold.

Once you’re there, obsessing over “more profit” can quietly cap your growth. Because profit hides things: weak systems, patchwork ops, and decisions that don’t scale.

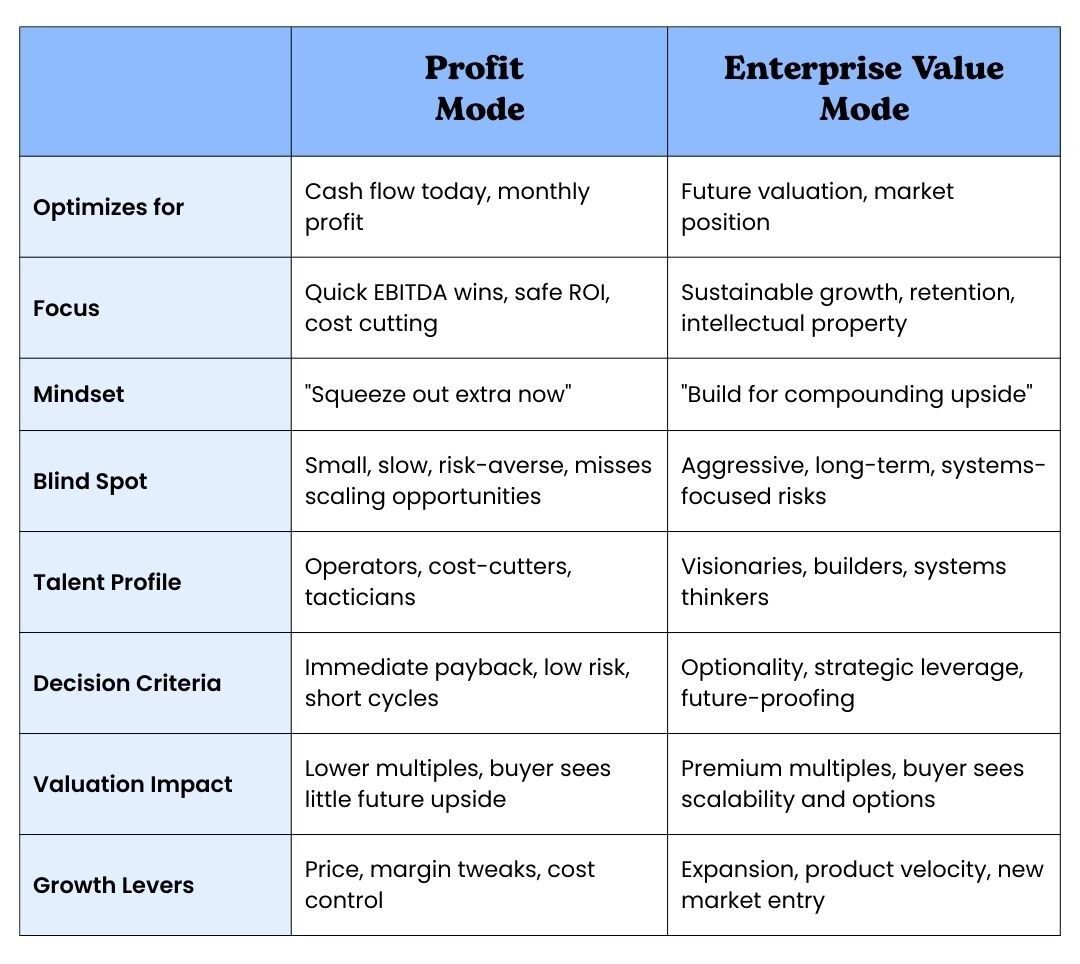

The shift most founders miss? After profitability, it’s no longer about squeezing margins; it’s about building enterprise value.

Not “how much do we make,” but “how well do we run?”

Even if you’re not planning to sell, using a buyer’s lens surfaces what profit masks: fragile workflows, founder dependency, growth bottlenecks.

Let’s dig into that.

The Margin

Where “Comfortably Profitable” Gets You Stuck

Reaching profitability feels like a milestone, and it is, but for many founders, it quietly becomes a trap.

Once the business is covering itself and money isn’t tight, urgency fades. Founders stop questioning systems, pricing remains stuck in legacy decisions, and dashboards replace actual insight. Profit gives the illusion of control, but often hides the underlying fragility.

I recently sat with a SaaS founder: $8M ARR, 26% growth, confidently profitable. On the surface, it looked solid. But under the hood? No proper financial reporting. No clear revenue recognition. Pricing decisions based on “what feels fair.” Internally, everything still ran through the founder’s brain.

When we mapped it against industry benchmarks, the result was obvious: not a bad business, just an undervalued one. Not because of revenue, but because the business wasn’t structured to scale without friction.

A buyer would see the gaps instantly and price them in.

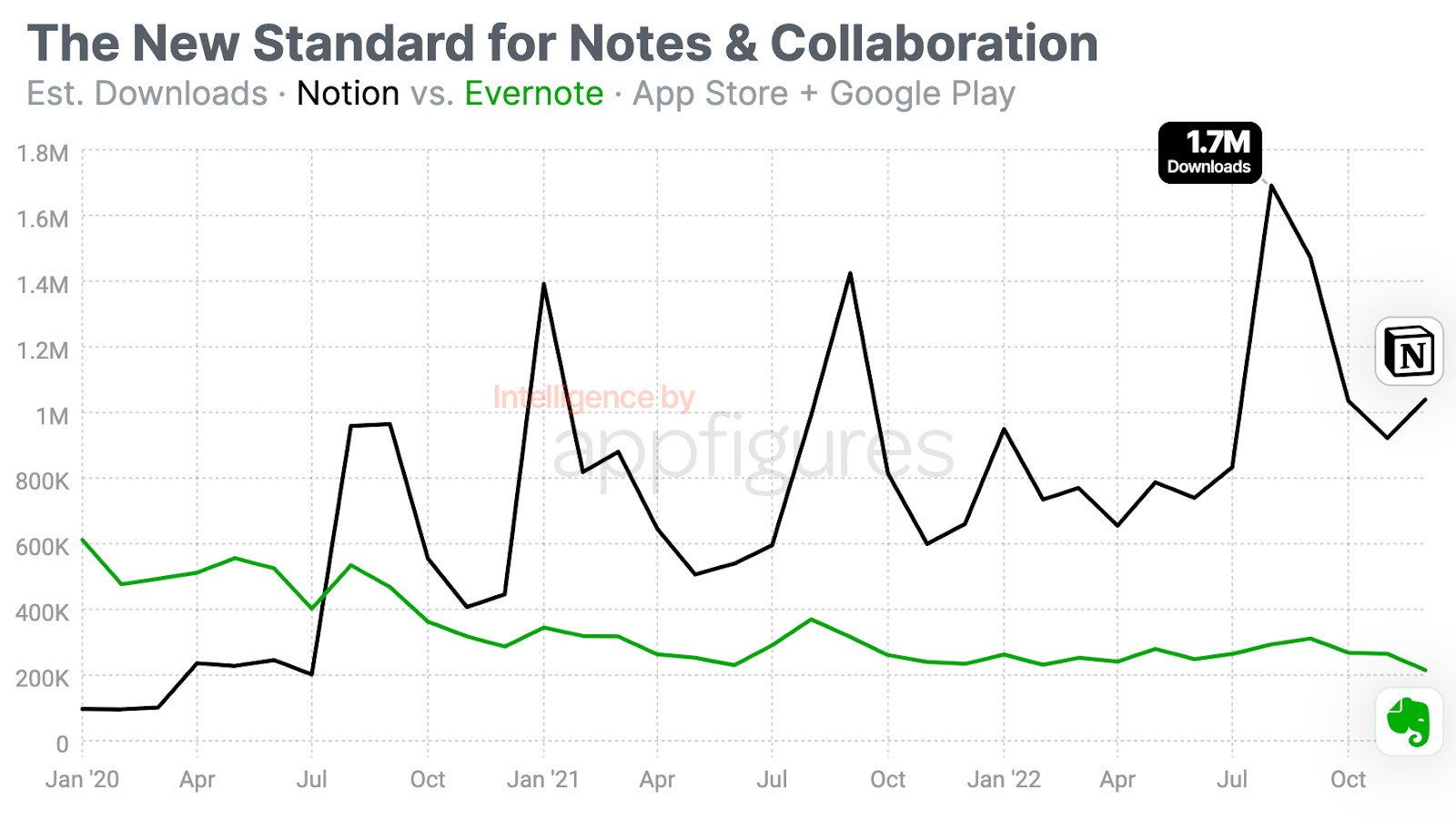

This isn’t rare. Evernote made the same mistake at a different scale. While they focused on preserving profit, Notion was compounding long-term value, improving product, widening use cases, and building defensibility. Notion went from $2B to $10B. Evernote got sold for less than its peak valuation.

The lesson: profit isn’t the goal, it’s the baseline. What matters next is whether the business gets more valuable over time. And that requires a different lens.

Why Enterprise Value Actually Matters

1. It reveals what profit hides.

Ask yourself: Would I buy this business tomorrow?

That one question surfaces fragile systems, messy books, and risks your P&L won’t show.

2. It forces better operations.

Building for EV means tightening your numbers, simplifying decision-making, and designing systems that don’t rely on your constant oversight.

3. It increases your payout.

Buyer-ready businesses, clean, scalable, founder-independent, trade at double or triple the multiple. Ignoring EV doesn’t just slow you down. It costs you millions.

Enterprise value isn’t just for exits. It’s how you scale smarter, and build something that actually lasts.

What Raises Enterprise Value?

It’s not just Revenue × Twitter multiple. Here’s what buyers and investors really pay for:

Predictable, recurring revenue

Strong, defensible margins

Systems that run without you

Audit-ready financials & clean contracts

A leadership bench that isn’t just you

Consistent, market-beating growth

No cap table, IP, or customer-concentration red flags

If it’s not documented, diversified, or automated, it’s at risk. And here’s the stat that matters: 70–80% of companies that go up for sale don’t sell.

Why? They fail on these exact points: messy ops, weak numbers, or businesses that break without the founder in the room.

Fix these levers, and suddenly your business becomes not just fundable but desirable.

(Buyers/Investors after you work on these)

5 Margin Moves That Build Value

1. Audit Revenue Quality

Check your concentration: >40% from your top 3 clients = risk.

Churn, repeat purchases, retainer rates, if you can’t track them, start this week.

→ Action: Pitch 5 new clients if one makes up >30% of your revenue.

2. Benchmark Against the Best

Compare your metrics to trusted benchmarks:

SaaS Capital, Bessemer, Shopify, or top-tier agency data.

→ What’s below par? Fix that first.

3. Tighten Margins & Unit Economics

Know your numbers:

Gross Margin: SaaS >75%, ecom >50%, services >50–60%.

LTV: CAC should be 3:1 or better.

→ Action: Raise prices 10–15% on your top offers this week.

4. Get Audit-Ready

Could you send clean financials + contracts in 10 minutes?

You should.

→ Create a basic data room and update it monthly: P&L, contracts, KPIs, org chart, IP docs.

5. Remove Founder Bottlenecks

Find the 3 tasks that only you touch.

→ Record a Loom, assign an owner, or automate it by Friday.

Tough Love Corner

A founder wrote me recently:

“We’re 15 people. We track MRR and customer count, nothing else. No NPS, no team targets, barely any dashboards. I want the team to think more like owners, but I don’t want to kill our culture with a flood of KPIs. How do we bring in structure without drowning in it?”

For lean teams, too many metrics slow you down faster than too few. You don’t need complexity, you need clarity. Not dashboards for dashboards’ sake, but a clear direction that everyone can rally behind and actually act on.

Start with a single North Star, whatever truly drives growth in your model (MRR, onboarding complete, weekly active users, etc).

Don’t just name it, anchor it. Explain why it matters and how it connects to their day-to-day decisions.

Then add one or two supporting metrics that directly influence that North Star. Assign owners. Make reporting dead simple: a shared doc, one weekly all-hands, and a culture where metrics are tools for action, not decoration.

The goal isn’t more numbers. It’s alignment.

Pick what matters, make it visible, and build a team that knows how to move it.

Got a burning founder question?

Send it my way, just hit reply.

Founder’s Toolbox

Best picks this week:

Before you go…

Profit keeps the lights on.

Enterprise value keeps the business standing when you step away.

This week, ask yourself: Would I buy this business tomorrow, at full price?

If the answer isn’t an immediate yes, that’s not failure.

That’s the start of your roadmap.

That’s the moat you build next.

See you next Thursday

— Mariya

What did you think of today’s issue?

Hit reply and let me know. I read every single one (for real).

About me

Hey, I’m Mariya, a startup CFO and founder of FounderFirst. After 10 years working alongside founders at early and growth-stage startups, I know how tough it is to make the right calls when resources are tight and the stakes are high. I started this newsletter to share the practical playbook I wish every founder had from day one, packed with lessons I’ve learned (and mistakes I’ve made) helping teams scale.