Tactical insights for first-time founders to outsmart the burn, the churn & the breakdown.

Hey Founder,

I see you, the SaaS builder chasing growth, the agency owner juggling delivery, the side-hustler at midnight. Different paths, same goal: building a business worth more tomorrow than it is today.

But if someone had to run your company right now, would they fight to own it or walk away?

Because value isn’t just revenue. It’s ease, stability, predictability, independence. The things that make your business less stressful for you - and more valuable to anyone else.

And these aren’t “later” fixes. Every decision compounds from day one.

So in this issue, we will break down how to build a company you’d love to run forever, while keeping the option to walk away, profitably, anytime.

The Margin

The $7.5B Reason to Fire Yourself

When Microsoft bought GitHub for $7.5B, it wasn’t just the code. It was that ANYONE could run it. Clear paper trail. Clean processes. Systems that scaled without the founders.

Laura Roeder did the same with MeetEdgar. A tiny team, smooth operations, and when she sold, the 7-figure deal closed in two months.

Washio did the opposite. After raising $17M and expanding to seven cities, each ran operations differently. Customers noticed. Logistics failed. The whole thing collapsed.

I also see too many businesses make the same mistake: relying on one key person. Growth stalls, value disappears.

The throughline: buyers don’t just want your product or revenue. They’re buying predictability, stability, and a business that runs without you.

Why You Should Care (Even If You Just Started)

- Tiny cracks become big breaks. That “we’ll fix it later” missing process? Tomorrow it could mean lost customers, chaos, or stalled growth. Just ask Blockbuster - streaming was rising, late fees were hated, stores were clunky… and ignoring those signals killed them.

- Early habits hardwire your company. A quick Slack approval here, an undocumented process there, it all compounds until it’s nearly impossible to untangle.

- And the later you fix it, the higher the cost. Cleaning up early takes hours. Cleaning up at exit costs multiples of profit. Target’s Canadian launch is proof: an untested inventory system led to empty shelves and a full shutdown in just two years.

And here is ….

Tiny Reframe

Stop thinking exit strategy. Start thinking options strategy.

Because building a sellable business isn’t only about selling. It’s about building freedom to choose:

– Do you want lifestyle freedom or a soft landing into retirement?

– A big exit… or fuel for your next startup?

– Or maybe keep it forever, but without being chained to it?

Get clear early, and you won’t waste years stuck in pivots or uncertainty. Instead, you create real options, so when the time comes, you choose the path. The path doesn’t choose you.

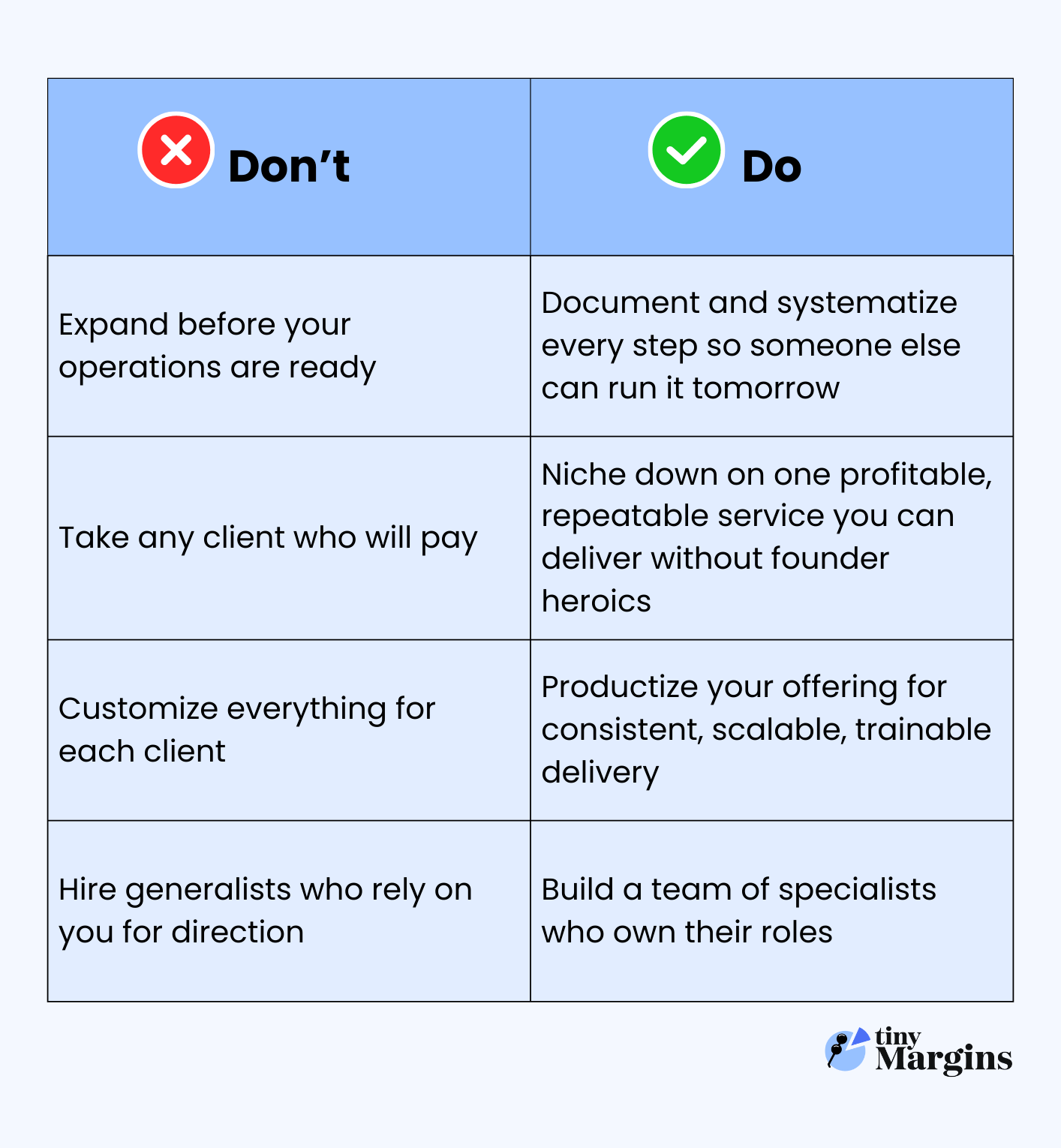

Margin Moves You Can Run This Week

1. Clarify your endgame

Write down your real goal: freedom, exit, or legacy?

Ask: Why would customers, or a buyer, choose my business without me at the center?

If you sold today, what’s the one thing that would spike your value vs. a competitor?

2. Systemize one workflow

Pick a process you touch daily (onboarding, billing, fulfillment). Document the steps in plain English.

Hand off one of those steps this week. Train, set expectations, and schedule a check-in.

3. Clean up your numbers

Pull your last 2–3 years of P&Ls and statements into one folder.

Make sure software, invoices, and bank balances all agree.

Fix messy or unclear transactions now, before they pile up.

4. Lock down your IP

Audit brand names, domains, code, and proprietary material. Make sure the business owns them, not just you.

If anything’s missing, file the paperwork this week.

5. Protect & boost margins

Check margins on your top 3–5 offers.

If margins are thin, raise prices and explain the added value to your customers.

Cut costs by renegotiating at least two contracts or subscriptions.

By week’s end, your bottom line should already feel lighter.

Tough Love Corner

A founder emailed me this week:

“After a year of slogging solo, my agency finally has momentum. But my only senior freelancer, the one who keeps clients happy, says he’ll only stay if I make him a partner with equity. I get it, he’s done a lot, but this agency is all I’ve got.”

My take:

Don’t hand out equity out of fear. Ownership is forever. Before you say yes, ask yourself:

Would I choose this person as a long-term partner?

Will they help make the business more sellable?

Can I design things so the business doesn’t depend on them or me?

If you can’t check all three boxes, equity’s not the move. If delivery hinges on one freelancer, that’s not a business, it’s a dependency. Treat this as your wake-up call to fix it.

Other options? Profit or revenue share. Bigger scope of responsibility. Or a 3–6 month “prove it” pilot before committing. And whatever you do, start building backups - train juniors, find alternatives, diversify risk.

Equity should signal growth, not desperation. If saying yes feels like relief instead of excitement, that’s your answer: pause.

Got a burning founder question?

Send it my way, just hit reply.

Founder’s Toolbox

If you want premium offers, think like a buyer: smooth operations, steady growth, no hidden mess.

Two tools to help you see the gaps:

SaaS Exit Readiness Dashboard: scores you across financials, product, and ops so you know exactly what to fix.

Exit Readiness Questionnaire: a deep-dive checklist from Equip Financial Partners on the legal, operational, and positioning issues that quietly kill valuations.

Before you go…

This isn’t about an overnight breakup with your business. It’s about one step at a time: document, delegate, repeat.

Every system you capture, every task you hand off is a brick in your freedom wall, making your company sturdier, calmer, and more valuable.

That’s the moat worth building.

See you next Thursday,

—Mariya

What did you think of today’s issue?

Hit reply and let me know. I read every single one (for real).

About me

Hey, I’m Mariya, a startup CFO and founder of FounderFirst. After 10 years working alongside founders at early and growth-stage startups, I know how tough it is to make the right calls when resources are tight and the stakes are high. I started this newsletter to share the practical playbook I wish every founder had from day one, packed with lessons I’ve learned (and mistakes I’ve made) helping teams scale.