Tactical insights for first-time founders to outsmart the burn, the churn & the breakdown.

Hey Founder,

There’s one question that haunts even the most seasoned teams, and it’s not about product, competition, or hiring. It’s this: “How many months do we actually have left?”

Runway isn’t just a number. It’s your company’s nervous system. Too little, and every decision becomes reactive, panic disguised as strategy. Too much, and complacency sneaks in quietly, eating away at urgency and focus.

But here’s the truth: runway is not mysterious. It’s just a function of two levers:

Revenue: how effectively you monetize the value you already create, and

Cost: how wisely you allocate capital. Change either, and you buy yourself time.

Change both, and you change the trajectory.

In this issue, I want to show you how you can unlock 6–12 months of runway without fundraising, without layoffs, just by finally seeing what’s been quietly costing you more than it should.

The Margin

Grown-up companies build muscles and cut fat.

Think about getting fit. Any decent coach gives you the same two rules:

Eat more protein so you have something to build with.

Cut junk calories so your body stops storing trash.

In business, that’s your margin strategy:

Revenue is your protein. And most companies are under-fueling. Not because they can’t sell, but because they undercharge, avoid tough pricing conversations, and delay expansion until it’s “perfect.”

Costs are your calories. Spending doesn’t stop. But every line item should earn its place. Tools no one logs into, hires without a clear multiplier effect, initiatives no one would fight for, those are junk calories draining your system.

When serious operators turn the ship, they don’t wait for better market conditions. They take a scalpel to these two levers.

HubSpot was growing fast, but with unstable revenue. Customers bought single tools, then churned when needs shifted. Their fix? Bundle the products. Lead with a free CRM. Create natural expansion paths. Result? Today, HubSpot’s growth engine is driven not by new logos, but by deepening value across their base.

Twilio had strong top-line momentum, and still bled cash. They cut the noise: sunsetting low-impact bets, streamlining teams, and refocusing on their core messaging platform. Within quarters, they flipped from burning millions to generating free cash flow.

LEGO, a household name, was once weeks from collapse. The turnaround came from ruthless prioritization: closing theme parks, ending side bets, and channeling investment into the core brick product. They didn't just survive. They set the stage for nearly 9× revenue growth.

Different companies, different industries, same operating truth:

Runway doesn’t extend itself. You earn it by improving how you monetize and how you allocate.

Tiny Reframe

A short runway doesn’t create problems; it just makes them impossible to ignore.

Suddenly, everything shows up in painful clarity:

Which customers actually generate profit, and which ones just drain your team?

“Must-have” expenses that don’t move product, revenue, or retention, at all.

Features no one would notice missing, if all you shipped was the core.

Hard decisions you’ve deferred because a comfortable bank balance made it easy.

If you have less than 12 months of runway, your job isn’t to keep things running. Your job is to change the mix, what you sell, who you sell it to, and what you spend on, fast enough that the math starts working again.

(A question that can reveal a lot…)

Why Runway Management Actually Matters

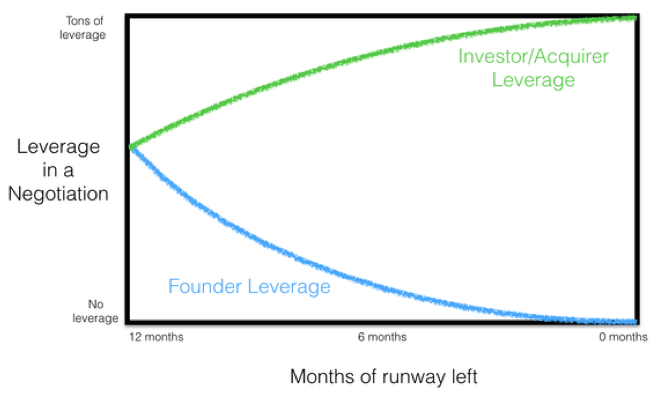

Runway gives you negotiating power. With time on the clock, you can walk away from bad-fit customers, brutal clauses, or misaligned investors. Without it, you take whatever’s offered, and often sell pieces of the company just to keep the lights on.

But runway is more than just a buffer; it’s your built-in BS detector. Actively managing it reveals what’s actually driving revenue, and what’s just legacy spend, pet projects, or inertia disguised as strategy.

If the only time you look at runway is in emergencies, you’re not just gambling with survival. You’re choosing to learn the most expensive lessons in the hardest way possible.

3 Margin Moves That Can Buy You 6–12 Months of Runway

These aren’t abstract frameworks.

They’re 30-day passes any founder can run - with a spreadsheet, a few honest conversations, and a refusal to keep subsidizing bad decisions.

1. Run the 30‑Day Junk Spend Sweep (Cost Lever)

Goal: Cut 10–30% of operating costs without touching headcount.

Step 1: Pull the receipts

Export all non-payroll expenses from the last 60–90 days. Focus on:

SaaS tools

Contractors and agencies

Ads and sponsorships

Travel, perks, “team culture” line items

Assign one owner per line item.

Step 2: Ask the only question that matters

“If I killed this on Monday, would you fight me on it?”

Then tag each item:

Green: “I’d fight you.” Keep. Direct tie to revenue or product.

Yellow: “Maybe?” Shrink scope, renegotiate, or give 30 days to prove value.

Red: “No way.” Pause or cancel. Watch what happens.

Apply this same logic to:

Marketing channels with unclear ROI → pause or reduce until CAC and payback are crystal clear.

Vendors → ask your top 5–10 for new terms: price cuts, or shift from Net 30 to Net 45/60. Even a few weeks can unlock meaningful working capital.

Most teams discover they’re burning 30–90 days of runway on “nobody ever questioned it” spend.

2. Make Your Best Customers Fund Your Runway (Revenue Lever)

Goal: Grow revenue with customers who already trust you, without extra acquisition effort.

Step 1: Segment your base

Sort customers by revenue over the past 12 months:

Top 10–20% → Your keepers. High margin, low noise.

Bottom 20–30% → High-effort, low-yield accounts.

This pattern exists in nearly every business.

Step 2: Build something better, for the right people

Talk to 5–10 of your best customers:

“What’s still slow, frustrating, or costing you time?”Look for where you already provide hidden value, and charge nothing for it.

Package the answers into a premium tier: Think “Pro,” “Priority,” or “Executive” 1.5–3× your standard price.

Add real value: faster turnaround, custom dashboards, founder access, onboarding support, etc.

Roll it out quietly to top customers over 30–60 days.

Step 3: Adjust pricing going forward

For new deals, raise pricing by 15–30%.

Leave current customers alone unless you’re in true survival mode.

Price changes are the cleanest margin lever: more revenue, minimal cost added.

Step 4: Stop subsidizing the wrong accounts

For low-revenue, high-noise customers:

Add minimums

Simplify offers

Say no to custom work unless it’s 3–5× your average deal size

Same customer base. Clearer segmentation. Higher margins. Runway improves, without panic.

3. Fix Your Cash Timing (Cash Flow Lever)

Goal: Pull 3–6 months of revenue forward, without sacrificing margins.

Step 1: Offer strategic prepay, not desperation discounts.

Build one clear prepay upgrade:

“Pay 12 months, get 1 month free”

“Prepay and get priority onboarding or support”

Don’t default to 30–40% off. Trade a small concession for time on the clock.

Step 2: Change when you get paid

If you run on services or project work, move from “pay when it’s done” to:

50% upfront

25% at a clear milestone

25% on delivery

Define milestones by time or output, never by “almost done.”

This isn’t about raising prices. It’s about cash hitting your account when you need it.

Step 3: Get serious about collections

Tighten payment terms. Use frictionless payment links.

Assign one owner to chase late invoices every single week.

No more “we’ll follow up soon.”

Companies that treat payment terms like a growth lever unlock new working capital, without new revenue.

(oops… okayy)

Tough Love Corner

A founder asked me:

“Runway’s tight. I’ve cut costs, pushed sales. What now?”

If you're stuck, it’s usually because you're trying to keep five plans alive and not running any one of them properly.

Do this instead:

Pick one constraint: cash, pipeline, or conversion.

Turn it into one move: cut $X this week, run 50 outbound reps, test one new offer on every call.

Track one metric. Weekly. Nothing else.

Then commit 70% of your energy for 8–12 weeks. No new priorities. No second-guessing.

Most founders don’t fail from picking the wrong lever. They fail from pulling too many at the same time.

Got a burning founder question?

Send it my way, just hit reply.

Founder’s Toolbox

A few sharp finds this week:

Default Dead/Alive and Fatal Pinch: Paul Graham on Runway

Before you go…

Runway isn’t “months until you die.”

It’s how many smart decisions you can still make before desperation takes over.

Most wait too long and let the clock decide for them.

The smart ones move while they still have room to think.

Even a few extra weeks of clarity?

That’s your moat. Worth protecting.

See you next Thursday,

— Mariya

What did you think of today’s issue?

Hit reply and let me know. I read every single one (for real).

About me

Hey, I’m Mariya, a startup CFO and founder of FounderFirst. After 10 years working alongside founders at early and growth-stage startups, I know how tough it is to make the right calls when resources are tight and the stakes are high. I started this newsletter to share the practical playbook I wish every founder had from day one, packed with lessons I’ve learned (and mistakes I’ve made) helping teams scale.