Tactical insights for first-time founders to outsmart the burn, the churn & the breakdown.

Hey Founder,

You’ve either passed this point, are approaching it, or you’re stuck right in the middle of it.

The $100K MRR zone.

Customers are buying. The product works. The team’s stable. For the first time, things feel… calm.

And that’s the risk. Because $100K isn’t a milestone, it’s a comfort trap. It’s a really nice couch. And way too many founders sit down, take a breath… and never get back up. Growth slows, urgency fades.

Getting beyond this point usually means doing two hard things: breaking something that currently works, and making a bet that feels risky before it pays off.

In this issue, we’ll look at why startups plateau at $100k MRR and what it really takes to reach $250K, $500K, or $1M.

The Margin

The revenue plateau no one talks about

Manu Kumar (K9 Ventures) calls it the Plateau of Complacency, that stretch between $100K and $200K MRR where growth stalls, but nothing’s broken.

The product works. Customers are paying. The founder is still the closer, the fixer, the engine. That feels good, but it creates fear. You hesitate to change anything, worried you’ll break what’s finally working.

But the real shift has already happened: your job is no longer doing the work, it’s building a business that works without you.

This pattern shows up everywhere.

Mailchimp sat flat for years until a forced technical decision pushed them into offering a free plan. Within 12 months, their user base exploded 5x.

Baremetrics hovered around $25K MRR until they dropped distractions and doubled down on a single core product.

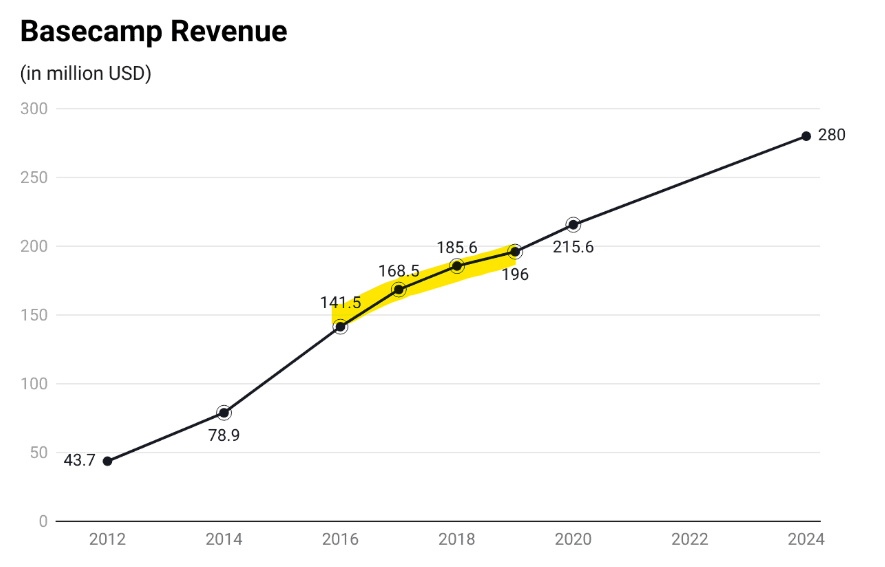

Basecamp coasted on polite, flat growth, then restructured pricing and unlocked real scale.

(The plateau of complacency in action - 4 years nearly flat)

These companies weren’t broken; that was the problem. They were stable, but not evolving.

Every new revenue tier demands a new company. The plateau happens when you keep trying to scale the old one.

Why startups stall around $100K MRR

It’s rarely a demand issue. More often, it’s because three things haven’t evolved in sync with the business:

1. Sales Fit: No repeatable sale

You’ve proven people want what you’re selling, but can someone else sell it? If a competent salesperson with a decent playbook can’t reliably close deals without you in the room, you don’t have Sales Fit. You have Founder Sales. And that doesn’t scale.

2. Acquisition Fit: No dependable channel

Early growth comes from hustle: LinkedIn, intros, podcasts, partnerships. Everything contributes, but nothing repeats. If you stopped engaging for 60 days, would you still have a pipeline?

If not, you haven’t nailed Acquisition Fit.

3. Model–Market Fit: The math stops working

When you’re just starting, pricing is flexible. At scale, that flexibility turns into chaos. The neediest customers pay the least. The biggest ones demand the most.

Every deal feels like a custom job, and your margins reflect it.

At this stage, you need a clean model: fixed pricing, solid unit economics, and less complexity per dollar earned.

(How the $100K mark feels like)

Tiny Reframe

Growth ≠ more of the same

Growth isn’t about doubling down on what used to work. It’s about recognising when your old playbook has expired. Each revenue band is a different game, with its own rules. Keep playing the $10K game at $100K, and the plateau isn’t a bug; it’s exactly what that game produces.

Revenue bands as different games

(Adapted from Manu Kumar’s milestones)

$0–1K MRR: Prove pain, not product.

Validate that a real, urgent problem exist, and that someone will pay to solve it.$1–10K MRR: Pick who you're for.

Narrow your focus. Most revenue should come from customers who look alike, not just anyone willing to swipe a card.$10–100K MRR: Build one engine.

Turn fit into repeatability, a reliable channel and sales process that works without you on every call.$100–250K MRR: Escape the Plateau of Complacency.

Stop focusing on total revenue. Watch the slope, is it steepening or flattening?$250–500K MRR: Build a company, not just a product.

Hire a lean GTM team, control burn, and make sales work end-to-end without founder intervention.$1M+ MRR: Make growth boring.

Systematize what works. Each new dollar should be easier to earn, cheaper to win, and less reliant on the founder.

3 Margin Moves to break plateaus 🧗

1. Name your revenue band and align to it

Fill in the blank:

“We’re a $_ MRR company, so our job right now is _.”

Examples:

→ “We’re a $20K MRR company; our job is to build one engine.”

→ “We’re a $110K MRR company; our job is to rebuild the model so it works without me.”Then audit your calendar:

🟢Green = directly supports that job

🟡Yellow = maintenance

🔴Red = work from a previous stage (early-stage sales, founder firefighting, hand-holding every customer)

Still spending most of your week in the red? That’s the plateau showing up in your schedule.

Change your calendar. Or the plateau will change your growth.

2. Run a quick plateau diagnostic (for ~$50K–150K MRR)

This one’s about alignment: which customers stick, which ones don’t, and whether your model’s worth scaling.

Filter in the customers that stick:

Look at the last 12 months. By segment (size, use case, industry):

→ Who’s still paying after 6–12 months?

→ Who churned? Who escalated?Filter out customers who block scale:

Which segments churn quickly, demand custom work, or overload support?

Make a “don’t sell to” list, buyers who shrink margins or require discounts/features just to close.Sanity check your model:

If your business 5×’d tomorrow, same ACV, margin, and support load, would it still be worth it?

If not, pricing and packaging need a rethink.

The plateau is often your model telling you, “I don’t scale.”

3. Pick one winning channel, and go all in for 90 days

Founders who break through plateaus usually don’t “try everything.”

They commit to one channel and build it into an engine.

Rank all your channels (SEO, content, outbound, partnerships, etc.) by closed revenue, not leads.

Pick the winner. Commit 80% of your effort there for the next quarter. Everything else becomes maintenance.

Define a simple funnel: lead → conversation → close. Track: Conversion at each step. CAC and payback, just for that channel

Ask yourself: “If this were the only channel I could use for the next 90 days, what would I change today?”

That’s how engines get built. That’s how plateaus get broken.

Tough Love Corner

A founder asked me:

"I’m raising ~€2M in Europe. Some investors are pushing me to ‘think US’, maybe even flip to a US parent. When does that actually make sense?"

Here’s the honest answer: At pre-seed or seed, don’t design your company around a hypothetical US flip.

Design it around proof, real traction, retention, and solid unit economics in your home market and maybe one or two adjacent ones.

Before product–market fit, a US parent company usually adds cost and legal complexity, not fundability.

A flip only makes sense when a serious US lead (typically Series A or later) says: “We’ll lead, but we need a US entity.” That’s when you do it, once, properly, with the right advice.

Until then, stay lean. Sell into the US if it makes sense. But don’t pre-optimise for a future that hasn’t happened yet.

Got a burning founder question?

Send it my way, just hit reply.

Founder’s Toolbox

A few sharp finds this week:

Before you go…

Every plateau is a signal: it's time to evolve your instincts, your focus, and how you lead.

Think of it as a promotion, or even a reset.

Because real growth doesn’t just come from scale.

It comes from upgrading how you think.

That’s the moat.

See you next Thursday,

— Mariya

What did you think of today’s issue?

Hit reply and let me know. I read every single one (for real).

About me

Hey, I’m Mariya, a startup CFO and founder of FounderFirst. After 10 years working alongside founders at early and growth-stage startups, I know how tough it is to make the right calls when resources are tight and the stakes are high. I started this newsletter to share the practical playbook I wish every founder had from day one, packed with lessons I’ve learned (and mistakes I’ve made) helping teams scale.