Tactical insights for first-time founders to outsmart the burn, the churn & the breakdown.

Hey Founder,

Building a business is like lifting weights. Add too much too soon, and your form collapses. The reps don’t count if you’re off balance.

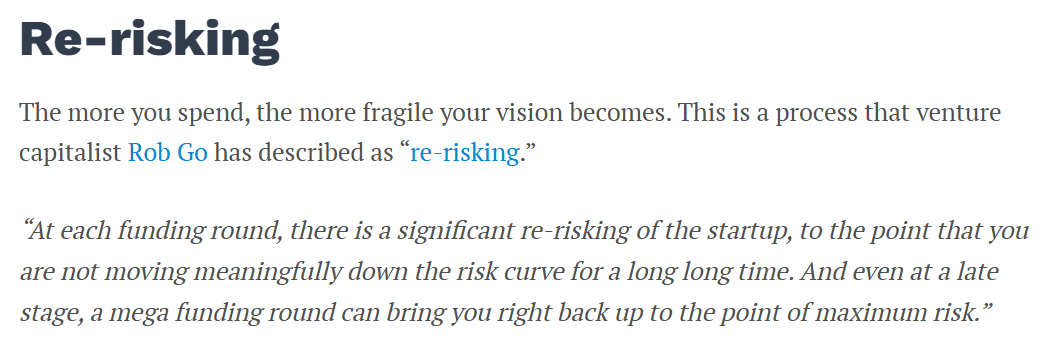

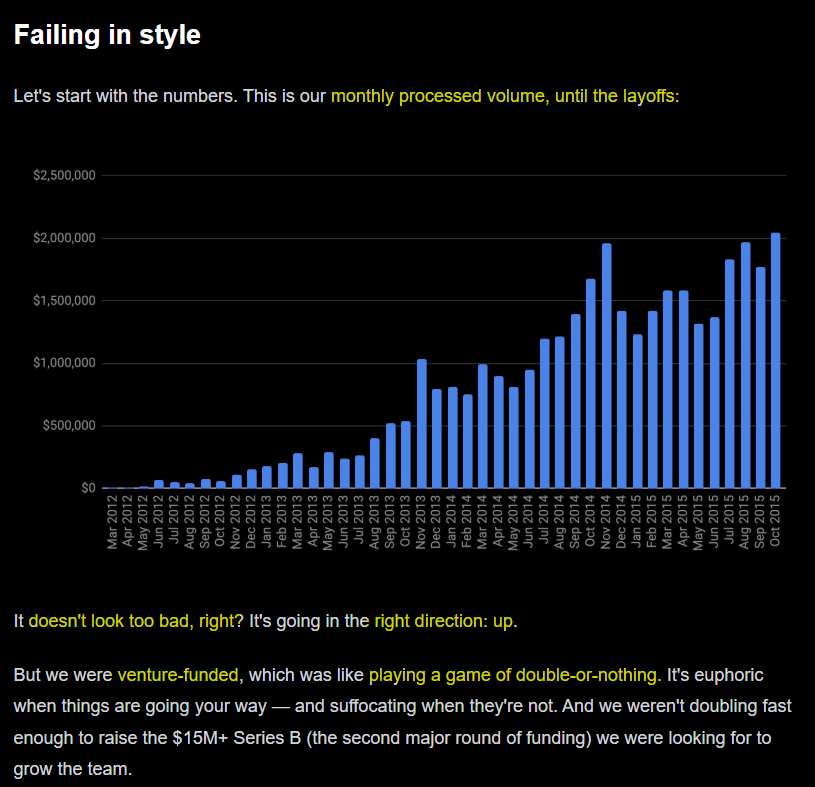

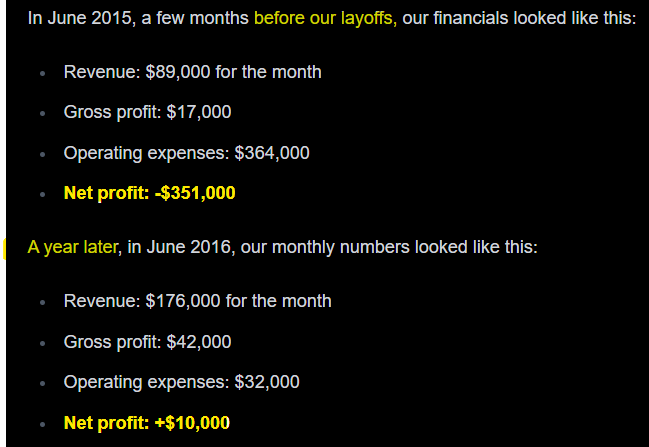

More funding? It doesn’t always mean more freedom. Whether you’re running a VC-backed rocketship or a thriving local business, too much capital too early lets you skip the hard reps: discipline, focus, customer truth. And it can bury you under pressure you weren’t built to carry yet.

This week’s issue dives into why overfunding kills - not just in Silicon Valley, but in everyday scale-ups too - and what you can do to avoid becoming the next cautionary tale.

Let’s dig in.

The Margin

The Dream That Kills the Dream

Funding feels like freedom - limitless runway, fewer trade-offs, full creative control.

But in truth? Constraints sharpen instincts. Without them, you lose your edge.

Too much cash too early doesn’t accelerate growth. It distorts it.

When Startups Learn the Hard Way:

Fab.com ($336M raised):

Acted like it had already “made it.” Scaled headcount, inventory, and burn $12M/month without proving retention.

Valuation: $1B → $15M in under 2 years.

Money didn’t fix the cracks. It buried them.

Color Labs ($41M pre-launch):

Tried to invent a social photo app… without defining its user.

Cofounder Bill Nguyen later admitted:

“We threw a mountain at people.”

Cash let them skip clarity and pay the price.

Main Street Isn’t Immune:

Gold’s Gym

Scaled fast on PE cash. But when fitness shifted to boutique and digital, they couldn’t pivot.

Heavy debt meant no agility. Bankruptcy followed.

Dickey’s Barbecue Pit

Overextended on SBA loans. Franchises popped up faster than demand.

Many shut down within 18 months, leaving owners with $400K+ in personal debt.

The Common Thread:

Startups overfund and lose discipline.

SMBs overborrow and lose flexibility.

Both trade away constraint, the sharpest tool they had, for a false sense of security.

As Sahil Lavingia (Gumroad) said after his $10M “reset”: “Money doesn’t fix your blind spots. It magnifies them.”

(From Sahil’s Essay)

Why You Should Care

Whether you’re chasing VC rounds or bootstrapping your way up, the money can break you before it builds you.

Startups:

70% fail due to premature scaling, growing before they’ve nailed the model.

7 in 10 teams implode by expanding too fast, too soon.

VC capital comes with a catch: pressure to grow 10x, even if you’re not ready.

SMBs:

Overexpansion, not competition, is the top cause of cash crunch.

82% of small biz failures come down to cash flow mismanagement, usually triggered by debt.

When the market shifts, debt turns into a trap.

No matter which path you’re on, once money starts steering the vision, you lose your sharpest edge:

discipline.

Tiny Reframe

Cash Is a Mirror

Money doesn’t change who you are. It magnifies it.

If your systems are sharp, capital scales them.

If they’re messy, it multiplies the mess.

Ample Hills Creamery had the hype, but not the infrastructure. Logistics broke under pressure. The result? A multimillion-dollar meltdown… in ice cream.

Canva, on the other hand, took nearly 10 years to deploy its $570M. They built lean, scaled intentionally, and earned the right to go global.

Both had money. Only one had discipline.

Margin Moves to Leverage Capital

Part 1: How To Not Over-Raise

1. Fund Proof

Fund Proof, Not Hope

Only raise what it takes to prove the next milestone.

Startups: Tie every round to traction (e.g. $1M ARR, 10–20% growth, or 60% retention).

SMBs: Fund one revenue-generating project that breaks even fast.

Capital should validate traction. not buy time.

2. Match Capital to Discipline

Runway: 12–18 months (startups), 3–6 months (SMBs).

Efficiency: Keep burn multiple <1.5×. Only expand from profit.

Dilution/Debt: <20% per round or DSCR ≥1.25×.

3. Know Your Sanity Bands

|

Stage 1: Validation |

Stage 2: Expansion |

Stage 3: Scale |

|

|---|---|---|---|

| Startups |

Pre-Seed ($500K–$1.5M) Prove problem–solution fit. |

Seed ($2M–$5M) Prove early product–market fit. |

Series A ($8M–$15M) Prove scalable go-to-market. |

| SMBs |

Bootstrapping / Micro-loan Prove demand and margins. |

Reinvest profits / Local loan Add capacity once core runs smooth. |

Strategic debt / Partners Amplify what already works. |

Raising outside your stage? Make the case. You want the next round to look inevitable, not desperate.

Part 2: How to Spend Money Without Wasting It

4. Model the “No-Funding” Timeline

Run two models: one with new capital, one without.

If the funded version adds payroll and complexity without hitting milestones 30% faster, rethink the raise.

More money ≠ more progress.

5. Run a 90-Day ROI Test

Every dollar has 90 days to prove it moved the needle.

Track cash in → value out: revenue, margin, retention, delivery speed.

No output? Cut it or reallocate.

6. Spend in Tranches

Don’t release 100% of the budget on Day 1.

Tie internal gates to results (retention, breakeven, etc.).

Only keep 3–6 months of ops “unlocked”, guard the rest from yourself.

Tough Love Corner

A founder wrote in:

“We went from 3 to 19 people in under a year , a few senior hires included. Costs have jumped, but I can’t tell who’s driving results and who’s just adding overhead. Where do I start without hurting morale?”

Make output visible, tie roles to results, and design direction so people can steer themselves.

1. Measure output per head

Pull the last 6 months. Calculate Revenue ÷ FTE month by month.

If it hasn’t climbed 10–15% since the hiring wave, you added weight, not leverage.

Example:

6 → 12 people while revenue moves $1.2M → $1.3M isn’t scale. It’s drag.

Don’t jump to layoffs. First, find the stalls, duplicates, and dead ends.

2. Make Every Role Prove Its Worth (Tie Role to Results)

For each seat, finish this sentence:

“When this person performs at 10/10, ___ moves.”

Acceptable answers: revenue, gross margin, retention, delivery speed, NPS.

If nothing material changes when they’re gone for 30 days, the role is fuzzy.

Redefine scope, set expectations, create a 30–60–90 plan, and inspect weekly.

3. Design direction so you can step back.

At 3 people, the direction is ambient. At 10+, it must be designed.

Write it down: one quarterly outcome, three priorities, clear owners.

Repeat it until everyone can say it back.

When direction is obvious, accountability is natural and morale survives.

Got a burning founder question?

Send it my way, just hit reply.

Founder’s Toolbox

Here are 3 resources worth your time:

YC’s Guide to Seed Funding → The Whys, Whens & Hows

Sequoia’s Guide on Runway Discipline → How to stretch your oxygen

My Fundraising Checklist for Founders → From prep to post-raise

Before you go…

Capital is a tool, not a trophy.

The best founders treat it like oxygen: enough to breathe, never to float.

So if you're planning your next raise…

Raise clarity.

Raise discipline.

Raise strategy.

That’s the real moat.

See you next Thursday,

— Mariya

What did you think of today’s issue?

Hit reply and let me know. I read every single one (for real).

About me

Hey, I’m Mariya, a startup CFO and founder of FounderFirst. After 10 years working alongside founders at early and growth-stage startups, I know how tough it is to make the right calls when resources are tight and the stakes are high. I started this newsletter to share the practical playbook I wish every founder had from day one, packed with lessons I’ve learned (and mistakes I’ve made) helping teams scale.