Tactical insights for first-time founders to outsmart the burn, the churn & the breakdown.

Hey Founder,

Today’s story might hit a nerve.

And if it doesn’t, it’s still one every founder should hear.

Picture this: you’re at a rooftop event in NYC, chatting with someone who could be your next investor, partner, or dream customer.

You say the magic word: bootstrapped.

Suddenly, their eyes glaze over. You’ve been downgraded. Not because your business isn’t solid, but because it doesn’t “look” fundable.

And that, right there, is the trap.

Let’s talk about why that mindset of looking “fundable" is broken and how it quietly kills good businesses every day.

The Margin

The Fundable Delusion

Let’s be honest: The startup world doesn’t reward sustainable growth; it rewards the appearance of it.

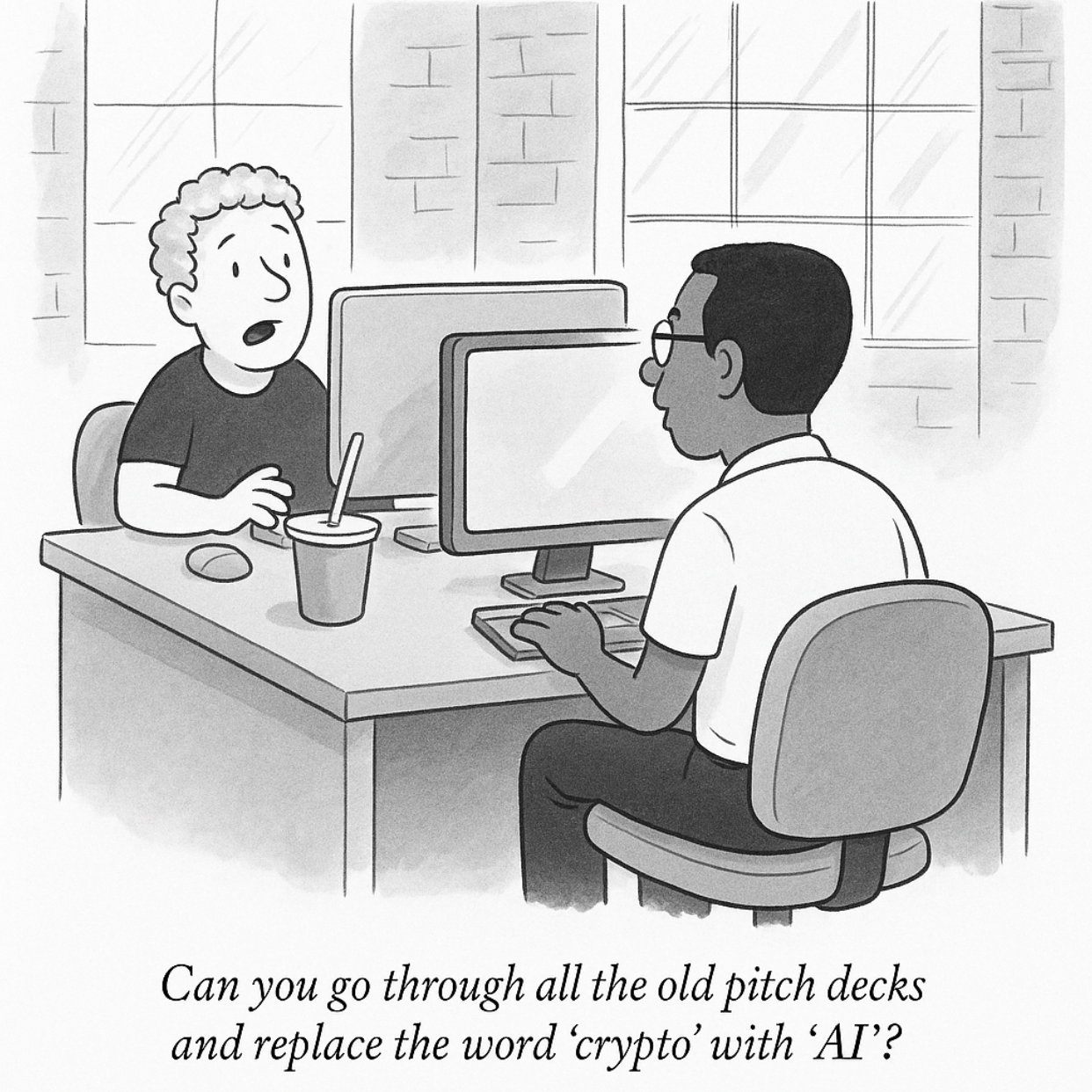

A great pitch deck. A “strategic” burn. Hockey stick projections.

We’ve glamorized the aesthetics of scale, not the substance.

I recently worked with a founder whose pitch looked airtight:

CAC trending down ✅

Churn “under control” ✅

Revenue set to triple ✅

But 10 minutes into the real numbers, the mask slipped.

Burn rate? Exploding.

Two paid channels that tanked? Omitted.

Retention after Month 4? In freefall.

This wasn’t deception.

It was the inevitable outcome of building a model for investors, not for operations.

When you start optimizing for the pitch, you stop optimizing for the business.

And that’s when the unraveling begins.

Tiny Reframe

A financial model isn’t a PR asset, it’s your early warning system.

It tells you:

Can we build next month without new revenue?

What breaks if we miss our targets for 60 days?

What do we pause now to avoid layoffs in Q4?

You don’t plan around capital. You plan around your runway.

(Yes, that’s your mic-drop moment.)

5 Margin Moves to Run This Week

Here’s how I suggest you stress-test your model:

1. Calculate Your True Runway

Cash ÷ Net Monthly Burn = Months of life.

Ignore “likely” raises. Use only the cash you actually have.

2. Audit Your Unit Economics

What’s your LTV:CAC ratio? What’s the payback period?

Gross margin is your forgiveness cushion.

3. Analyze Retention

Is your revenue sticky or leaky?

MRR growth only matters if customers stick past Month 4.

4. Run the Default Alive Test

Will you survive if no new money comes in?

Project your cash flow conservatively, don’t assume a bailout.

5. Model the Downside

Create a “what if” scenario: slower growth, rising costs, higher churn.

How long do you last? If mild shocks break your model, de-risk now.

Block 30 minutes this week, run these numbers, and see what you find.

Remember, rational optimism: if the story shifts, that’s not failure, it’s feedback. Now you get a chance to realign with what’s real.

Tough Love Corner

A pre-seed SaaS founder asked me:

“Why does everyone at events only ask how much I’ve raised, not about customers or revenue?”

Here’s the hard truth: funding is perceived as traction.

It’s easier to brag about a round than explain churn.

But the founders who win in the long run?

They’re not optimizing for pitch decks. They’re building real businesses.

So next time someone asks about your raise, say this:

“We haven’t raised. We’re post-revenue, customers are happy, and we’re figuring it out without dilution.”

That's the kind of founder investors regret overlooking.

Got a burning founder question?

Send it my way, just hit reply.

Founder’s Toolbox

Startup Cash Runway Calculator

Want to get a hang of your runway? Try this calculator.

A dead-simple spreadsheet to map burn vs. revenue.

Play with expense assumptions to see how long your cash really lasts.

I built this for the early-stage founders I work with. Now I’m sharing it here.

Grab the free template. Click below👇 to get access:

One Last Thought

You don’t need to take my word for it.

Founder Jason Fried built Basecamp into a double-digit million-dollar profit machine without taking a single VC check.

Nathan Barry calls Kit an “anomaly” for never raising funding (and he’s proud of it!)

Both grew by caring more about revenue and profit than term sheets.

They didn’t optimize for decks. They optimized for margin.

And that? That’s the real moat.

See you next Thursday,

—Mariya

What did you think of today’s issue?

Hit reply and let me know. I read every single one (for real).

About me

Hey, I’m Mariya, a startup CFO and founder of FounderFirst. After 10 years working alongside founders at early and growth-stage startups, I know how tough it is to make the right calls when resources are tight and the stakes are high. I started this newsletter to share the practical playbook I wish every founder had from day one, packed with lessons I’ve learned (and mistakes I’ve made) helping teams scale.